If you’ve ever wondered, “How much should I put away for taxes?” as an independent contractor, you’re not alone. Estimating the amount you’ll owe at the end of the year may seem more like dark magic than anything mathematically pinpoint-able. After all, anything can happen through the course of a year when you work for yourself and don’t operate on a fixed salary.

But there are steps you can take to prepare. It’s possible to get reasonably close to your annual tax liability at the start of the year using methods provided by the IRS.

In this article, we break through all of the accountant jargon to guide you to the answer the question, “How much should I save for taxes?” as easily as possible. No CPA required (except me).

Who Is An Independent Contractor?

Knowing your employment classification status with the IRS is the first step to determining how much to save for taxes.

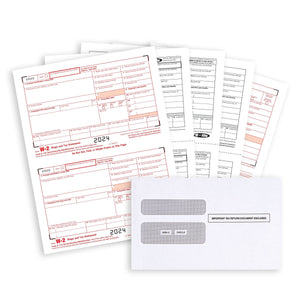

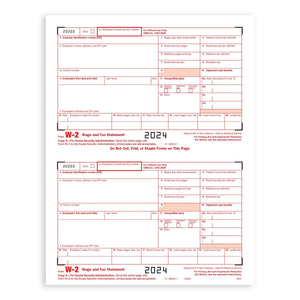

If you work for a business or another individual as an employee, your income is subject to payroll taxes. Federal income tax, state income tax, FICA, Medicare, and Social Security will be withheld from each paycheck and remitted to the IRS on your behalf. As an employee, you will receive a W-2 at the beginning of the following calendar year for work done during the previous year.

However, if you are classified as an independent contractor, this all changes. Designation as an independent contractor is somewhat subjective, but there are some key signs. The overarching indicator is whether you, as an independent contractor, have control over how the work will be completed. This can include factors such as what hours you work, the schedule by which you are paid, and the process you use to achieve the end product.

Here are some other indicators that you’re an independent contractor:

- You bring your own tools needed to complete your job

- You require little or no training for the agreed-upon work

- You may execute a contract with your customer at the beginning of a project

- You may be completing work for multiple customers at the same time

Professions commonly operating as independent contractors include hairdressers, consultants, general contractors, and doctors.

If any of this sounds familiar, the money you earn will be subject to Self-Employment tax in addition to income tax/ This means there is a little more legwork involved in estimating and remitting the taxes you owe to the government.

Estimating How Much to Put Aside for Taxes

The IRS requires quarterly deposits be made on the amount which you can reasonably estimate will be due for your current year of income. The basic steps for calculating this estimate are the following:

1. Estimate Your Annual Net Income from Self-Employment

The net income you expect to earn from self-employment can generally be calculated by subtracting your business expenses from your business income. This may sound easier said than done if you struggle with lost receipts for expenses or “shoebox accounting.”

One way to solve this common issue is to invest in a receipt scanner for taxes, though there are other ways to estimate your annual net income from self-employment.

If this is not your first year of operations, a good starting place may be your tax return from the previous year. For sole proprietors, you can find this information on Schedule C of Form 1040. You can adjust the income and expense amounts based on what you know or expect to change in the current year. Maybe you expect a certain percentage of growth or decline from the previous year, and you can apply that percentage to the bottom line net income on Schedule C. Alternatively, if you expect no significant change from how much you made last year, you can use the number from Line 31 of Schedule C of last year’s tax return.

If your business expenses exceed your business income, you have a net loss instead of net income, and net losses are not subject to Self-Employment tax.

2. Calculate Your Estimated Self-Employment Tax and Deduction

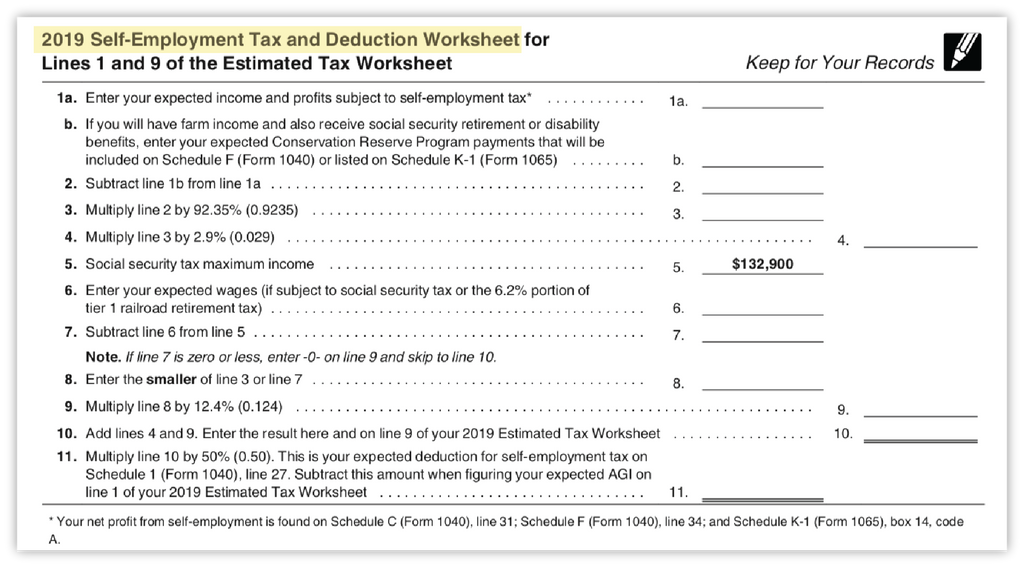

Self-Employment tax refers to the Social Security and Medicare portions of the total tax due to the government. Fifty percent of this amount is also deductible on your personal tax return. The IRS provides a worksheet you can use to calculate these amounts on page six of Form 1040-ES.

Additional Information on Self-Employment Tax:

- The percentage used to calculate Social Security tax is 12.4%. The percentage used to calculate Medicare tax is 2.9%.

- The amount of income subject to Social Security tax is limited to $132,900 for 2019. This limit is applied to the total amount of income you earn, which may include normal W-2 wages if you have them. Any income over the limit will not incur Social Security tax.

- If your income is only from self-employment and does not exceed the limit, a quick shortcut to calculate the self-employment tax is to multiply your income first by 92.35% and then by 15.3%. Fifty percent of this amount will be your Self Employment tax deduction.

3. Estimate Your Adjusted Gross Income (AGI)

Your Adjusted Gross Income is all taxable income minus certain adjustments to that income. To determine your gross income, include not just your self-employment income that we calculated in the previous step, but also any employment income that is subject to withholding as well as taxable interest and dividends, rental income, tips, bonuses, or capital gains. For divorce agreements executed since January 1, 2019, gross income does not include alimony payments received.

Adjustments to your gross income to determine AGI include student loan interest, IRA contributions, any alimony payments you are required to make under an agreement executed prior to January 1, 2019, as well as the fifty percent deduction of self-employment taxes we calculated in step two.

Deducting your expected adjustments to income from your gross income will give you your expected adjusted gross income.

4. Complete the Estimated Tax Worksheet

You are now armed with all the information you need to complete the Estimated Tax Worksheet provided by the IRS on page eight of Form 1040-ES.

As a note before getting started, you will want to consider all income and deductions relevant to your tax return in order to complete this worksheet. This means if you’re filing jointly with your spouse, include his or her income or deductions as well. Here are some plain-English tips for some of the lines in this worksheet.

- Line 1, Adjusted Gross Income – Use the number we calculated in step three, above.

- Line 2a, Itemized or Standard Deduction – You’ll want to choose the larger of your total itemized deductions or the standard deduction. Items to consider in determining what deductions you may be able to itemize include mortgage interest, charitable contributions, and medical expenses. However, the standard deduction was increased for tax year 2019, so it may be less likely that your itemized deductions would exceed the new amount.

- Line 2b, Qualified Business Deduction – This deduction can be a powerful tool in reducing your tax liability, but it can also be a bit complicated to calculate. A thorough explanation can be found here.

- Line 4, Tax – Use the tax rate schedules found on page seven of Form 1040-ES. For example, if a single person calculated his taxable income at $50,000, then he would be in the 22% tax bracket. His Line 4 tax would be calculated as $4,543 + .22($50,000 – 39,475) = $6,858.50.

- Line 5, Alternative Minimum Tax – The alternative minimum tax (AMT) is a complicated calculation that typically applies to higher income taxpayers. It is a process that calculates the amount of tax owed based on stricter rules and adds back certain deductions such as state and local taxes and depreciation to calculate an alternative minimum taxable income. If you have not previously been subject to the AMT and have experienced no significant changes in your income, it is safe to assume that you will not be subject to it during the estimation process. If you believe you are susceptible to additional tax under the AMT calculations, check out this explanation.

- Line 7, Credits – You may qualify for certain tax credits that directly reduce the amount of tax you owe. Tax credits are available in areas including homeownership, child and dependent care, and education expenses.

- Line 9, Self-employment Tax – This is the full amount you calculated in step two, above.

Using all of this information, you should finally come to an annual amount of tax you will need to pay during the year in order to avoid penalties. If the amount is greater than $1,000, you will need to divide it by four and pay the total amount in quarterly installments.

Quarterly estimated tax payments are due as follows:

- April 15

- June 15

- September 15

- January 15

Any Exceptions?

If the final annual amount you calculate after completing all the steps is less than $1,000, you are not required to make any estimated payments!

Also, if you had zero tax liability for the previous year, you are not required to make estimated tax payments.

One More Thing

Everything we’ve discussed above has you covered with the federal government. However, if you feel like you may be missing something, you’re probably right.

Unless you live in a state that does not levy an income tax (Alaska, Florida, Nevada, South Dakota, Texas, Washington, or Wyoming), you will also want to consider whether you will need to make quarterly payments to your state taxing authority. That information should be readily available with your state’s Department of Revenue.

And chances are good you won’t have to come up with any additional information other than what you’ve already completed for the federal tax estimate.

Let Me Sum Up

All the steps and calculations can be summarized into the general principle that if you do a little legwork, you can be fairly confident you won’t be stuck with a large tax bill (on top of penalties and interest) at the end of the year. Due diligence and reasonable estimating goes a long way. And, best of all, you won’t be haunted by the exhausting thought, “How much should I save for taxes?” every time you earn a paycheck.

Need more information on taxes? We’ve got you covered. Check out our resources and have a smooth, pain-free tax season.

To see what we’re up to, follow us on Twitter, Instagram, and Facebook. Or send us an email– Larry loves to hear from you!

This article is designed to provide accurate and authoritative information. However, it is not a substitute for legal advice and does not provide legal opinions on any specific facts or services. The information is provided with the understanding that any person or entity involved in creating, producing or distributing this article is not liable for any damages arising out of the use or inability to use this product. You are urged to consult an attorney concerning your particular situation and any specific questions or concerns you may have.