“Can you handwrite a 1099 or a W2?” is one of our most common questions surrounding tax preparation. The short answer is yes, you can fill out a 1099 by hand, but there’s a little more to it than that. Handwriting your tax forms comes with a long list of rules from the IRS since handwritten forms need to be scanned by their machines. A simple mistake like using the wrong color pen ink or adding a dollar sign where you’re not supposed to could cause errors on your forms.

In this post, we’ll answer can tax forms be handwritten, and well as a collection of other tax form questions we get asked most often. We’ll also share some best practices so that you can ensure your tax forms are error-free and up to IRS standards.

Below we’ll answer the following questions:

- Can you handwrite a 1099 or W2?

- Can I print my tax info on plain paper?

- Why do I need to buy special tax forms?

- Do I need paper with red ink?

- Can I fill out my tax form information with software?

- Can I efile?

- Is it time to make the switch to efiling?

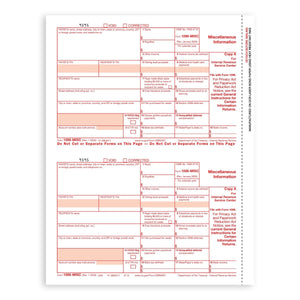

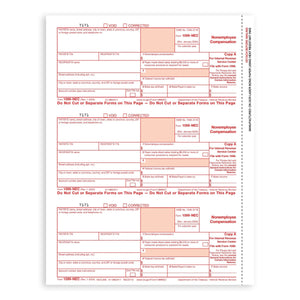

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments. Click here to learn more, or buy 1099-NEC forms here.

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments. Click here to learn more, or buy 1099-NEC forms here.

Can you handwrite a 1099 or W2?

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors.

The IRS says, “Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors. Handwritten forms often result in name/TIN mismatches.”

Know that if you choose to handwrite your tax forms, there is much more room for human error, and a simple mistake could mean a big headache for you and your business. Even if no transcription errors are made, there are still a number of rules to follow for how you handwrite tax forms. For example, there are certain characters you are not allowed to use, and you must always handwrite documents with black ink.

The best way to avoid these errors is to efile your forms. Efiling is the most accurate and efficient way of filing 1099s, W2s, and other tax forms. Plus, in the years to come, more and more businesses will be required by the IRS to switch to efiling.

The Taxpayer First Act aims to modernize and simplify the way Americans do taxes. The Act, which was signed into law on July 1, 2019, expands efiling and mandates more businesses file their taxes electronically. Learn more about the benefits of efiling and how to do it.

Best Practices for Handwritten W2s and 1099s

Use Plain Block Letters

When handwriting any tax form, always use legible block letters. If any letters are in a script font, or if they are disproportionate, they will not be read correctly by the machine readers. Practice ahead of time to ensure you don’t make a mistake. Take your time, and if you haven’t written with block letters in a while, test out your handwriting on another piece of paper to make sure your writing is clear.

Use Black Ink

Black ink is required for handwriting tax forms. This is because other colors, including blue and red ink, cannot be read correctly by IRS machines. Test your pen on another piece of paper before you begin filling out your forms. Ensure it won’t smudge as you complete the form so that you don’t waste any forms or create marks that would confuse machine readers.

Include a Decimal Point

When writing a dollar amount, always include the decimal point even if the decimal point conveys zero. You always need to add the cents portion of any money amounts. $500 would be written 500.00, not 500, or $500.

Do Not Add Dollar Signs

For dollar amounts, do not include the dollar sign. These are already preprinted on the tax forms. Adding extra symbols will only confuse the machine readers.

Do Not Use Special Characters

Avoid any other symbols, unless otherwise stated to use one. These are unneeded, and they could confuse machine readers resulting in an error on your form.

- ampersands (&)

- asterisks (*)

- commas (,)

- apostrophes (')

- or other special characters

Do Not Change the Title of Any Box

Leave form titles as you find them. Don’t make changes to headings in order to add different information. You can only use the form to report the information that is expressly asked for on that form. Use the appropriate boxes to answer each question and do not include supplemental information.

If you are unsure, ask before filling out your form incorrectly. The IRS says,“If you are unsure of where to report the data, call the information reporting customer service site at 866-455-7438 (toll free).”

It’s better to ask in advance than to find out later that you made a mistake on your form. Corrections can take weeks to sort out when paper filing, and depending on the mistake, there’s a chance you could incur a penalty.

If a Box Does Not Apply, Leave it Blank

You may not need to fill out every box. If one does not apply to you or your business, leave it blank. Don’t enter anything else to convey a non-answer because the machine reader could interpret that as an answer you did not intend.

For example, when no entry is required, don’t use:

- 0

- Zero

- None

- N/A

- Not applicable

Keep Forms Intact

Handwritten W2s, 1099s, and any other tax forms must remain intact. Don’t staple, tear, or tape any of the forms as these will interfere with the IRS's ability to scan your documents. If you need to keep a section of forms together, use a paperclip that you remove before sending your forms or a file folder instead of anything permanent.

Can I print my tax info on plain paper?

You can either use preprinted W2 and 1099 forms that are ready for you to fill out, or you can print W2 and 1099 forms from your home or office as long as you use the appropriate ink, paper, and dimensions required by the IRS. The IRS requires perforated paper for the employee copy. They need to be easy to separate or already separated.

Why do I need to buy special tax forms?

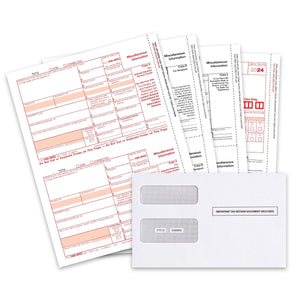

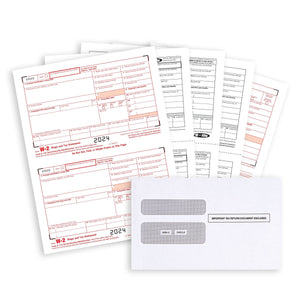

You need to ensure all of your tax forms meet IRS specifications. The simplest way to do this is to purchase preprinted tax forms or choose efiling—more on that below!

Blue Summit carries all of the preprinted tax documents you need to file W2s and 1099s.

Do I need paper with red ink?

Yes. If you are paper filing, you are required to use the preprinted red ink IRS forms or print your own as long as you follow all current IRS guidelines around ink, paper, and required dimensions.

Can I fill out my tax form information with software?

Yes. You can use a commercial tax preparation software such as Quickbooks to transmit tax forms through IRS approved electronic channels.

Can I efile?

Yes! Efiling is more secure and more accurate than handwriting your tax forms. We highly recommend businesses consider efiling 1099s and W2s.

Our quick, easy efiling platform makes it simple to efile W2s and 1099s. We use state-of-the-art security, digital recordkeeping, as well as full app integration with Excel and other accounting software.

Is it time to make the switch to efiling?

The Taxpayer First Act requires more and more individuals and businesses to make the switch to efiling. Check if you will be required to make the switch this year or in the coming years. Efiling is simpler, quicker, and results in far fewer errors than the paper method. If you’re going to have to switch sooner or later, why not make the switch sooner?

More From Blue Summit Supplies

💡 Learn how to organize, create, and keep track of your receipts with our guide on How to Organize Receipts.

💡 All About Tax Form Mailing: 1099 and W2 Envelopes, including the difference between 1099 and W2 envelopes and where you can purchase tax envelopes.

For more informative articles about office supplies, subscribe to our email newsletter!

For more informative articles about office supplies, subscribe to our email newsletter!

Never fear, you won't begin receiving daily sales emails that belong in a spam folder. Instead, we promise a fun weekly roundup of our latest blog posts and great finds from across the web. And if you lose interest, it's always easy to unsubscribe with a single click.

We’re big on office organization and we love helping businesses and individuals find the best tax filing options. Follow our blog for the latest trends, strategies, product comparisons, and more.

If you have any questions or want to talk to someone at Blue Summit Supplies, send us an email or connect with us on Twitter, Facebook, or Instagram.

This article is designed to provide accurate and authoritative information. However, it is not a substitute for legal advice and does not provide legal opinions on any specific facts or services. The information is provided with the understanding that any person or entity involved in creating, producing or distributing this article is not liable for any damages arising out of the use or inability to use this product. You are urged to consult an attorney concerning your particular situation and any specific questions or concerns you may have.

4 comments

Lizzie

Hi Vita,

I believe that question is best answered by a tax professional! I would start a Live Chat with ComplyRight at the below link and see if they can’t help you!

ComplyRight Live Chat: https://support.custsupp.com/hc/en-us/articles/210239146-Live-Chat-

Vita Xu

The vendor haven’t provide their TAX ID, and we will file on paper form. Should I wirte "refused " in the Tax Identification Number (TIN) box or leave it blank?

Justine

Hi Shirley,

We do not carry 1040 Forms, however I would suggest looking into E-Filing. Here is a link from the IRS about E-File options: https://www.irs.gov/filing/e-file-options

- Justine

Shirley Anderson

I have been trying to locate a 1040 form please help