If you’re wary of submitting your personal data to the cloud or if you feel like you don’t have the resources or time to electronically complete and file your tax forms this year, then you might be thinking you want to do things “old school” and just print and hand write everything. You might be wondering, ‘can I print 1099 on plain paper?’ and whether or not your 1099s, W-2s, and other tax forms can be handwritten. Keep it simple, right? Well, not so fast.

Although the IRS will accept handwritten forms, they do caution that the writing must be completely legible and accurate in order to avoid errors in processing. In fact, most accountants, myself included, would tell you that more often than not, handwritten forms lead to errors and delays in processing. Of course, you may still want to pursue this option, but you should definitely weigh your other options for filling out and submitting tax forms before making a final decision.

To help you out, this article will explain the requirements and options for preparing and submitting tax forms such as W-2s, 1099s, and returns. The topics we’ll cover include:

- requirements for printing tax forms

- the IRS expectations for handwritten forms,

- locating IRS business partners,

- obtaining tax forms to mail,

- Tax Form Preparation (TFP) software, and

- e-filing.

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments. Click here to learn more, or buy 1099-NEC forms here.

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments. Click here to learn more, or buy 1099-NEC forms here.

Paper for Printing Tax Forms

When it comes to tax forms, there are some strict printing and paper guidelines to adhere to:

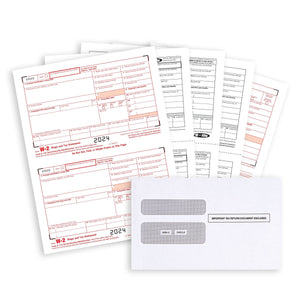

- You can use plain white paper to print W-2 Copy A and W-3 forms.

- For Form 1099s, Copy A uses red ink and must be ordered from the IRS or purchased from a tax supply vendor. All other parts of Form 1099 can be printed on plain white paper.

- Additionally, you must use perforated paper for some copies of forms that you’re sending to employees.

Handwritten Tax Forms Guidelines

In addition to IRS form guidelines, if you decide to complete your tax forms by hand, the IRS requires that you follow these guidelines:

- Use block print rather than script or cursive writing. Most people use a combination of printing styles in their natural handwriting, so this can be harder than you might think. When using block print (all caps), you’ll need to also make sure that each letter is about the same size. This might sound easier than it is in practice, so practice on another paper before going ahead on your tax forms.

- Do not use hyphens, apostrophes, dollar signs, ampersands, asterisks, commas, or other special characters in the money amount boxes or on the payee name line.

- Print all of your data in the middle of the blocks, leaving plenty of space between each letter or number. Since the forms will be read by a machine, it’s important that the computer can easily tell where one number ends and another begins.

- Only use black ink. Forms filled out in any other color will be rejected.

- Include the decimal point and cents for all dollar amount entries. For instance, $120 should be written as 120.00.

- If a box does not apply, leave it blank. Do not enter 0, “None,” “NA,” a dash, or anything else into the boxes. The only exception to this would be if you are specifically asked to enter a 0 (zero).

- Do not staple or cut anything. Even if part of a form is left blank, you still need to include all parts and pages.

- All forms must be submitted as an original handwritten document. In other words, do not send in photocopies of any tax forms.

- You should not make any erasures, cross-outs or whiteouts. If you’re filling out a Form W-2, then the Copy A portion (the page printed with red ink) must be totally error free.

- Follow the IRS mailing guidelines, such as not folding documents and using a flat mailer instead of a typical envelope.

As you can see, even though it might sound easier in theory to complete the information on your tax documents by hand, in practice, it may be much more difficult and time consuming to complete your forms this way. If you go ahead with handwritten forms, make sure to make yourself photocopies for your records.

IRS Business Partners

If after reading these handwriting guidelines, you’ve decided that filling out handwritten forms sounds like too much for you, another option is to contact an IRS business partner. These professionals and organizations might be able to help you out for little to no fee as long as you only have a small number of forms to complete. Basically, this is a resource list of tax and other related business professionals who can help answer your tax questions and help you file your tax forms.

Obtaining Tax Forms to Mail

Whether you’ve decided to complete handwritten tax forms, use a typewriter to fill them in, or complete them on a computer and print them out, there are several ways you can obtain and/or complete your tax forms.

- You can place an online order with the IRS requesting that blank tax forms be mailed to you. You can also call the IRS at 800-829-3676 to place your tax form order. Typically, you will receive your forms within 10 business days after placing the order. Note that since the IRS receives a very low number of paper forms, some tax forms cannot be ordered at all. For the forms that are not available for order, you can find them online in fillable format to download and print. Note that there is also a limit of 1,000 for each of the forms that can be ordered as well as a limit to the number of instruction manuals that each person or business can order.

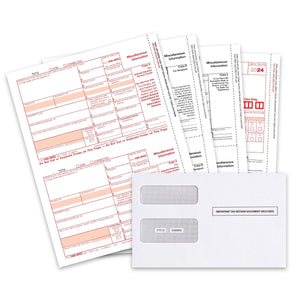

- You can purchase blank forms online from an office supply vendor. These can be shipped to you rather quickly, so if you’re in a time crunch, ordering and paying a small fee for these forms may make more sense than waiting for the IRS to mail them to you. These can also be purchased in kits with envelopes to make the whole process easier.

- You can use an online service or tax preparation software to help you fill out the forms using your computer. You will then print and mail the forms to the IRS yourself. Some of these kits also come with envelopes and step-by-step instructions for filling out the tax forms. Many of the software programs save your information so that filling out the forms next year will be easier as well.

The IRS cautions that if you’re looking at the PDF forms on the IRS website, you need to understand that many of those are only provided as examples and are not forms that can be filled in electronically and then printed for filing. Nor are some of the PDF forms meant to be printed and filled out by hand. You must either have software that generates the file according to the IRS specifications or you must purchase or order the IRS forms to fill in.

Tax Form Preparation (TFP) Software

If you’ve decided it would be better and easier to enter data onto your tax forms using a computer, then TFP software can help you do just that. TFP software not only helps you to legibly complete all of the needed information, but it also walks you through what to enter and where. Additionally, the layout of the software helps you avoid errors on your tax forms that could lead to headaches down the road. Often, the software comes in bundles with tax forms and envelopes so that you can purchase everything you need at once.

E-Filing

The IRS and most tax professionals urge clients to use e-filing rather than submitting handwritten tax forms. In fact, if you are distributing more than 250 Form 1099s, you must e-file. Additionally, by 2022, almost all businesses will be required to e-file, so it makes since to get used to this now.

Other benefits to e-filing include:

- Saving time. If you e-file, you’ll save time not running to the post office, office supply store, and handwriting your forms.

- Avoiding mistakes and fines. According to the IRS, only 1% of e-filed returns contain mistakes, while around 20% of paper returns do. And, remember, when it comes to the IRS, sometimes mistakes equal fines, which is something we all want to avoid.

- Receiving your refund more quickly. Since there are often less mistakes on e-filed forms, that means that it will take the IRS less time to process your return.

- Using less paper. Not only does this help the environment, but it also saves you money in printing and paper costs.

One way to get started e-filing your federal taxes is by using the options on the IRS website. Depending on your income, the IRS now provides free file software and forms, that can be used to easily complete the process.

Another option is to use a third party e-filing software to help you safely and securely file your tax forms online. This option can add the convencies of cloud storage, app integration, and digital recordkeeping to help you organize and maintain your tax documents.

Everyone knows that taxes are inevitable and usually not fun to think about or to complete. However, with the right tools, the process becomes much easier and less of a hassle. Although you may be tempted to complete everything on your own, if you have questions, it’s always best to contact the IRS or a tax professional before completing or submitting any tax forms.

For any other tax form-related questions, find Blue Summit Supplies on Twitter, Facebook, and Instagram. Or send an email– Larry loves to hear from you!

This article is designed to provide accurate and authoritative information. However, it is not a substitute for legal advice and does not provide legal opinions on any specific facts or services. The information is provided with the understanding that any person or entity involved in creating, producing or distributing this article is not liable for any damages arising out of the use or inability to use this product. You are urged to consult an attorney concerning your particular situation and any specific questions or concerns you may have.

For more informative articles about office supplies, subscribe to our email newsletter!

For more informative articles about office supplies, subscribe to our email newsletter!

Never fear, you won't begin receiving daily sales emails that belong in a spam folder. Instead, we promise a fun weekly roundup of our latest blog posts and great finds from across the web. And if you lose interest, it's always easy to unsubscribe with a single click.